MIDDLE MARKET

Database

Q4 2019

Valuations & Opinions Group

Inside this Issue

Private equity backed portfolio company performance remains robust as market participants remain cautiously optimistic.

Click below to navigate to each page

Key Takeaways in the Fourth Quarter of 2019

Middle market valuation multiples expanded to a ten-year high with leverage multiples slightly down…

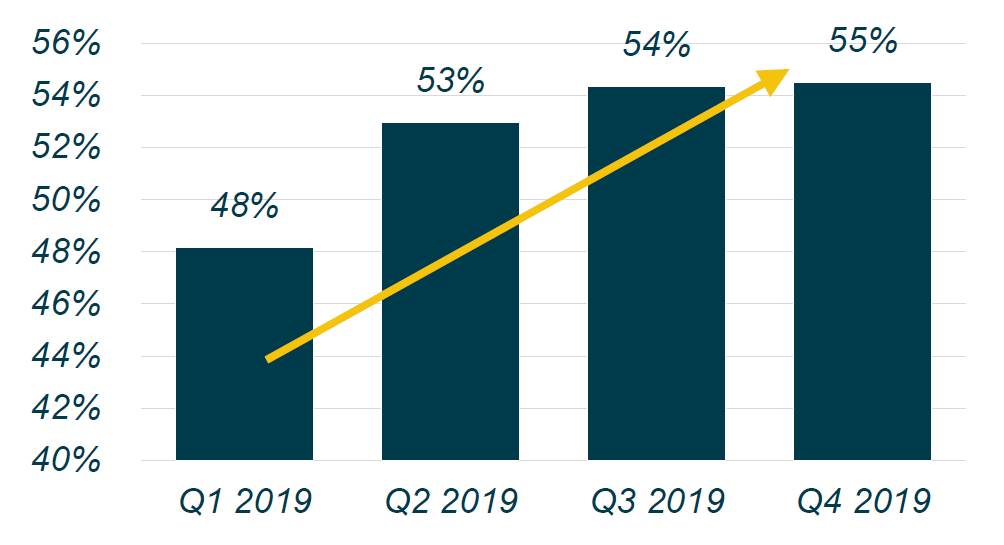

…and the percentage of companies reporting EBITDA growth reached a record high, all while nearly 25% of EBITDA was derived from adjustments…

…and a bifurcation of growth has manifested between cash-flow rich industries and others in the market…

…leading to the observed frequency of contractual limits on EBITDA adjustments when testing covenants to increase. (1)

(1) Per compliance EBITDA defined by ~1,500 Credit Agreements reviewed by Lincoln since Q1 2017

All while spread compression continued within the direct lending space as lenders compete to deploy capital…

…and the percentages of loans valued below 50%, 80%, and 95% of par have modestly declined.